On the evening of March 20, Fantawild (834793.OC) announced the release of its 2018 annual report, offering an in-depth look at its accomplishments for the year and future trends for the industry. Fantawild reported revenue of CNY 4.345 billion for 2018, a 12.49% increase over the previous year, and gained net earnings of CNY 776 million. For the year ending December 31, 2018, the total assets of Fantawild reached up to CNY 19.34 billion and net assets CNY 10.11 billion, with the latter rising by 6.60% over the beginning of the period.

Business Performance

Theme parks and cultural content products and service constitute Fantawild’s main business. Among them, theme parks were the main source of annual income, and accounted for 82.95% of the overall revenue in 2018. It is worth mentioning that theme park subprojects became a bright spot. For the current period, they grossed CNY 2.5 billion and raised CNY 260 million, an increase of 11.89% over 2017.

According to Fantawild, the revenue growth of the company is mainly attributed to the sound operation of Fantawild Asian Legend as well as the substantial rise in digital animation revenue. Opened in August 8, 2018 in Nanning, Fantawild Asian Legend focuses on the culture of Southeast Asia. It continues the success of the previous four park brands (namely Fantawild Adventure, Fantawild Dreamland, Fantawild Oriental Heritage, and Fantawild Water Park), and represents the superb creativity and cutting-edge R&D of Fantawild.

The report figures state that Wuhu Fantawild Adventure, which began operation in October 2007, was the first park open to the public. Currently Fantawild has built altogether 25 theme parks in over 10 large and medium-sized cities nationwide. On the whole, Fantawild shows a tendency of large-scale growth. In a wildly successful strategy, the thriving tourism and increasing individual consumption levels boost economy. This is complemented by the fact that Fantawild boasts a well-established industrial chain integrating innovation and creativity, research and development, production, and global marketing. All businesss egments including special-effects films, digital animation, and consumer products provide all-round supports to theme parks.

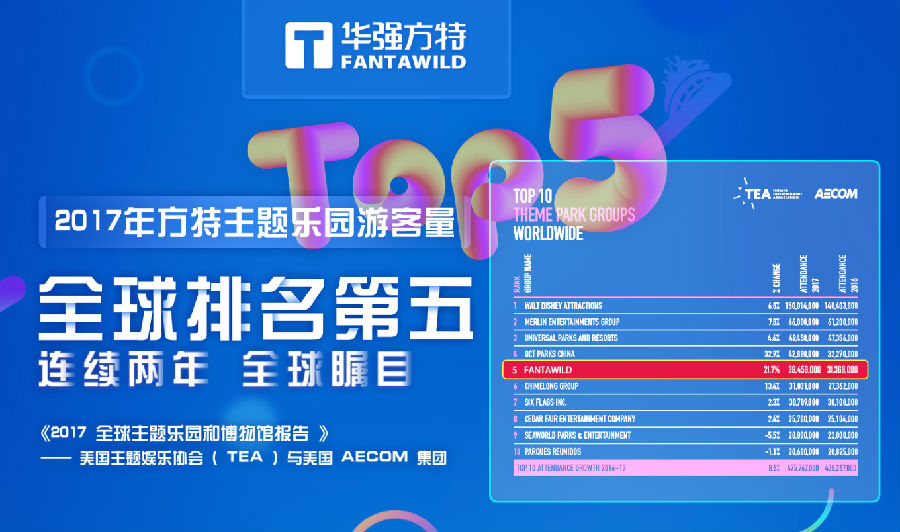

By following the strategy of combining culture and technology and intensely developing its intellectual properties, Fantawild was admirably listed into the “National Brand Plan” for two consecutive years. According to 2017 TEA/AECOM Global Attraction Attendance Report, Fantawild took the lead in the industry with its total number of tourists ranking 5th globally, 22% more than the previous year, which brought about sustainable profitability. For the market as a whole in 2018, the parks in twenty-odd cities contributed a gross profit rate of 72.39% together with the segments of special-effects films and animation.

By following the strategy of combining culture and technology and intensely developing its intellectual properties, Fantawild was admirably listed into the “National Brand Plan” for two consecutive years. According to 2017 TEA/AECOM Global Attraction Attendance Report, Fantawild took the lead in the industry with its total number of tourists ranking 5th globally, 22% more than the previous year, which brought about sustainable profitability. For the market as a whole in 2018, the parks in twenty-odd cities contributed a gross profit rate of 72.39% together with the segments of special-effects films and animation.

In the aspect of content production, animation revenue keeps boosting year by year. The overall income for animation in 2018 reached CNY 327 million. This sector raised CNY 110 million, an increase of 50.09% over 2017. Boonie Cubs 1 and Boonie Bears: The Big Shrink set new records of earnings on new media and in box office respectively. “Fantawild Cartoon” has proudly tailored an animation industrial chain ranging from pre-production (creative design), production, post-production, and all theway to program distribution.

In terms of research and development, Fantawild has independently developed advanced technologies like circle-vision 4D films and giant screen films. They have been applied in Fantawild theme parks and even sold worldwide. When it comes to consumer products, Fantawild carried out creative design based on its animation IPs, put them into mass production, and eventually sold products throughout theme parks.

It is notable that the deposit received for special-effects films and creative design, as well as animation income, brought Fantawild abundant cash flow. For the report period, the net amount of cash flow generated from company business enhanced by 82.63% to CNY1.83 billion compared with 2017. Monetary capital grew by CNY 440 million, a 110.21% increase over the end of 2017. Meanwhile, receivables were cut down by CNY 103 million, a 38.96% decrease over the end of 2017. The deposit received at the end of 2018 boosted by CNY 506 million, a 180.94% rise over 2017 year-end.

Future Outlook

Now there are over 10 theme parks under construction in cities like Changsha, Handan, Jingzhou, and Jiayuguan. Last year, Fantawild successfully signed new park projects in Jining, Xuzhou, Taizhou, and Shangqiu. It is estimated that by 2020, there will be over 30 parks in operation.

According to China Theme Park Pipeline Report issued by AECOM on November 8, 2018, the total quantity of visitors to Chinese theme parks has amounted to 190 million. By 2020, the number is expected to reach 230 million. The investment in theme parks to be built from 2018 to 2020 is as high as CNY 74.5 billion. The market for second- and third-tier cities in China has great potential and promising prospects.

With the increasing investment in domestic theme parks, insiders point out that we need to avoid blindly constructing parks with inadequate planning. Analysis indicates that the aggravation of market competition will build high industry barriers for enterprises that follow the “whole industrial chain model”. The future industry growth is expected to favor enterprises that own powerful IPs, chain-operated brands, and technical research and development.

In view of future development, Fantawild promised to step up cooperation with superior IPs and intensify advertising at public transport hubs, while attracting potential customers and strengthening the appeal and awareness of Fantawild simultaneously.

In terms of animation, more new IPs are ready to blow your mind in 2019! In the months to come, besides the annual Boonie Bears film and TV series, a new film named Realm of Terracotta will debut. All of these efforts in animation will in turn fuel theme parks into aleague of their own.